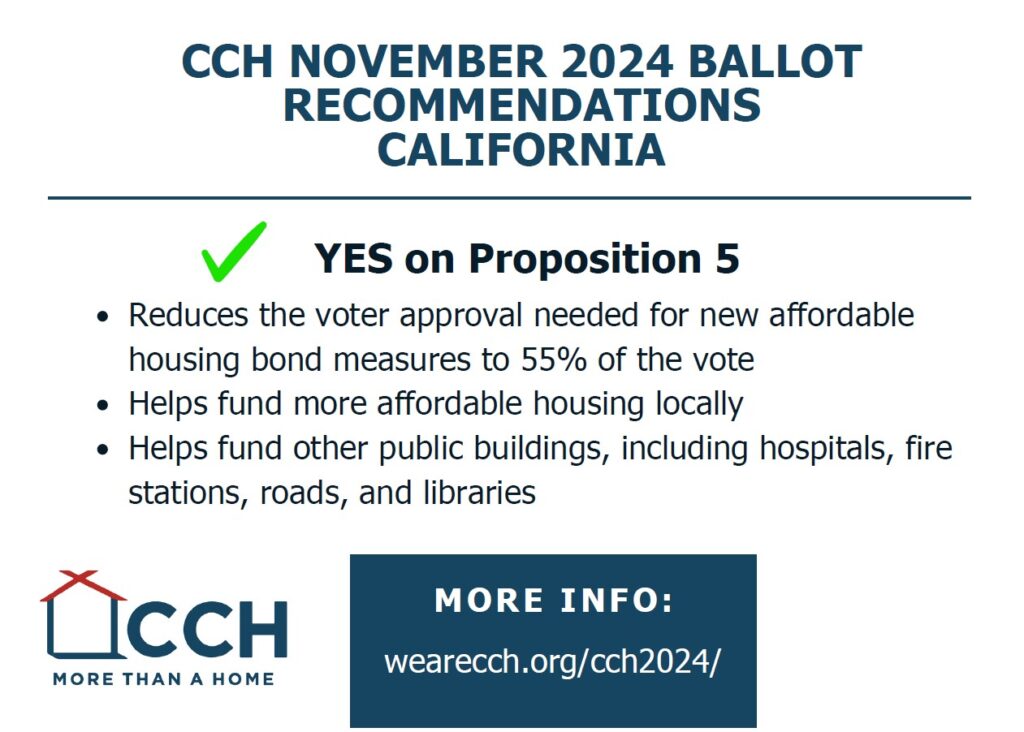

Unlocking Affordable Housing Funds at the Local Level

- CHANGES VOTER REQUIREMENTS

- Allows approval of new affordable housing financing with 55% voter approval.

- INCREASE AFFORDABLE HOUSING

- Makes Funding for affordable housing available in cities, counties, and the state.

- INVESTS IN OTHER INFRASTRUCTURE

- More fire stations, libraries, and hospitals.

- What is a general obligation bond?

- Questions General Obligation Bonds are a way for local governments to borrow money and then repay it with interest over time. It’s similar to a home mortgage or a credit card. For cities, counties, and other local districts, bonds typically require two-thirds of voter approval. These are called general obligation bonds and are repaid by increasing property taxes for property owners.

- Why 55%?

- Many cities, counties, and other districts want more funding for affordable housing. It is extremely difficult to reach the current two-thirds voter requirements to pass new general obligation bonds. with a 55% requirement, which is aligned with school bond voter requirements, affordable housing bonds are more likely to pass.

- What does “affordable housing” mean?

- Housing is “affordable” if it costs no more than 30% of one’s income. People who pay more than this are considered “cost-burdened”; those who pay more than 50% are “severely cost-burdened.”

- Affordable housing generally means affordable to lower-income people with incomes at or below 80% of Area Median Income (AMI). Most affordable rental housing programs target lower income people.

- How much more affordable housing will this bring in CA?

- An estimate of 20 to 50% of more affordable housing bonds would pass if Prop 5 passes. This could bring in an additional $2 billion for new affordable housing.